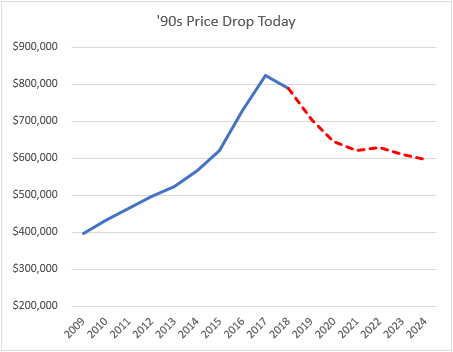

The last time Toronto had a major housing correction was nearly 30 years ago. After a decade of price growth, and five years of rapid price growth through the late ‘80s, prices retreated in Toronto in 1990. What ensued was seven years of falling home prices before a rebound finally took shape. In the end it took 13 years to return to the 1989 peak price, not adjusting for inflation.

If you ask anyone in the real estate industry, you will be assured that this could never happen to Toronto today. Toronto’s population is growing (it was growing at a higher rate in 1990), the economy is strong (there are many warning signs about the strength of the economy) and the housing market has achieved a soft landing (sales are down, and prices remain below 2017 prices), so we are told the market is just fine. But, for debate sake, let’s look at what might happen if a ‘90s level recession hit the housing market today.

Source: Six Housing Sense

Source: Six Housing Sense

From 1989 to 1996 the GTA’s housing market lost 28% of its total value. If this same decrease happened today, the average home price in the GTA would fall from $822,727 (2017) down to $595,654. This would eliminate all the gains from the past four years. The drop would happen gradually over seven years and bottom out in 2024. It would take the region until 2030 to fully recover from the recession and likely have a serious impact on the broader economy. In the immediate future, the GTA would end 2019 with the average home value being $704,254.

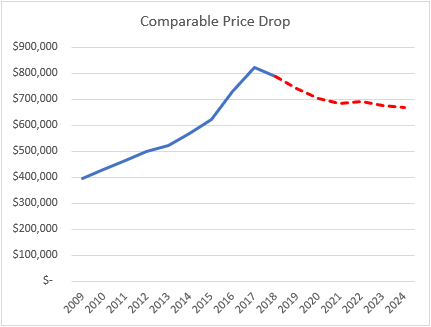

The run up of prices before the decrease in 1990 was incredible. From 1981 to 1989 the average home price in the GTA tripled from $90,200 to $273,700. In comparison to the recent price gains since the short-lived drop of 2008/09, home prices have slightly more than doubled from $395,460 to $822,727. If the potential reductions are in alignment with the gains, then applying the full price drop of the ‘90s would not apply to today, as modern gains were only 70% as strong. The below graph looks at a price reduction also at 70% the value of the ’90s decrease.

Source: TREB, Six Housing Sense

Source: TREB, Six Housing Sense

The comparable drop today would reduce prices by 19% from 2017 peak. A 19% price reduction would take the average home price to $666,409 by 2024. This reduction would still maintain prices above 2015 levels, though obviously be a significant drop. It is worth noting the price decrease from 2017 to 2018 was closely in line with what it should have been if it actually was the first step in a seven years housing recession.

This post is a complete hypothetical. Issues are arising in Toronto’s housing market; however, overall confidence remains, as prices have opened 2019 gaining slightly over 2018. Sales are struggling and though listings have stayed low to balance the market, it will be interesting to watch the spring market to see how sales and listings behave. If listings start to increase, the lower sales totals could start to have a big impact on prices. If that happens, these graphs might not be hypothetical anymore.

What about mix changes? There are a lot more condo apartments in today’s sales vs the 1990s.

LikeLike

Definitely. That’s a flaw in an average price comparison, doesn’t address the make up of the market.

LikeLike